FED and the Future of Bitcoin: Is the Majority Wrong?

Check out what to expect regarding risk assets in the decisive week of U.S. monetary policy.

Welcome to MrGekkoWallSt's virtual office!

This is issue number 01 of my newsletter! This is where I organize and share my insights on the market, technical analysis, education, experiences, reflections, and the most relevant news of the period.

Reflection

One of the great advantages of dedicating yourself full-time to the market is the availability to be actively or passively monitoring the changes in this space every day.

I remember as if it were yesterday how euphoric the cryptocurrency market was on April 14, 2021. For me, it was notably a day distinct from the previous ones because at that moment, Coinbase was going public on the American stock market.

The feeling I had on that day was exactly this: "This is too good to be true!" It's such a comfortable atmosphere that it really becomes difficult to believe in any scenario other than a continued rise and that good feeling.

You start to feel like you're halfway there, not at the end; this thing is reaching a new level. Memories of the previous cycle lead you to reinforce that this is exactly what is happening. In 2017, we had a bull market at the beginning of the year and another one at the end. The year 2021 seemed to be following the same protocol.

From April to July 2021, Bitcoin corrected by more than 56% and then began a retracement until it reached $69,000 in November of that year. During this new phase, the environment didn't seem to have the same fundamentals; the speculation around NFTs, meme coins, and other riskier assets were evidence of that. Capital wasn't flowing systematically; it was something concentrated and dysfunctional.

However, Bitcoin's move to a new all-time high seemed to endorse and make sense of that thing. Time today shows us once again that comfort and recency bias (the tendency for individuals to give more weight to recent events or information while disregarding older or historical information) are among the most dangerous elements in this space.

In this week's analysis, I will address:

Some straightforward technical concepts in the Bitcoin chart, which are unknown to a significant portion of the cryptocurrency market participants.

How people's psychology still remains anchored in pessimistic narratives and inaccurate assessments.

Oil continues to rise, and the Consumer Price Index (CPI), the primary inflation indicator in the USA, is on the rise again.

Over 95% of the market prices in a pause in the FED meeting on September 20th.

Bitcoin

Bitcoin seems to be on the verge of completing its bullish market's impulsive wave 1 consolidation, after an extensive bear market that extended from April 2021 to December 2022 (about 630 days).

This technical pattern still confuses many. An expanded irregular correction tests supply with a higher high (B) and then retraces in 5 waves (C).

This is one of the reasons why many traders are still calling for a drop to $12,000, believing that the real peak of Bitcoin was at (B), assuming the bear cycle hasn't concluded.

The $12,000 crew is also heavily biased towards recency, comparing the current period to 2019/2020 (COVID-19 crash), expecting a similar movement. Much of this negativity stems from the hypothesis of a recession in the United States.

The truth is that the current cycle is much more similar to the period from 2013 to 2017. Right now, Bitcoin is consolidating support in the green box, which may or may not hold.

The historical seasonality of October, November, and December, both in the traditional market and in Bitcoin, may be setting up for good returns. It's no surprise that September is the worst month for risk markets, whether marked by significant drops or low volatility. You can check out my links below for more information:

It's important to emphasize that Bitcoin will likely not follow the same pattern as it did from 2013 to 2017. Don't rely on that. What matters to us is the direction. There are many other tools that are more efficient at identifying the stages of a bull cycle than fractals. Keep following our newsletter regularly so you don't miss any of them.

Inflation

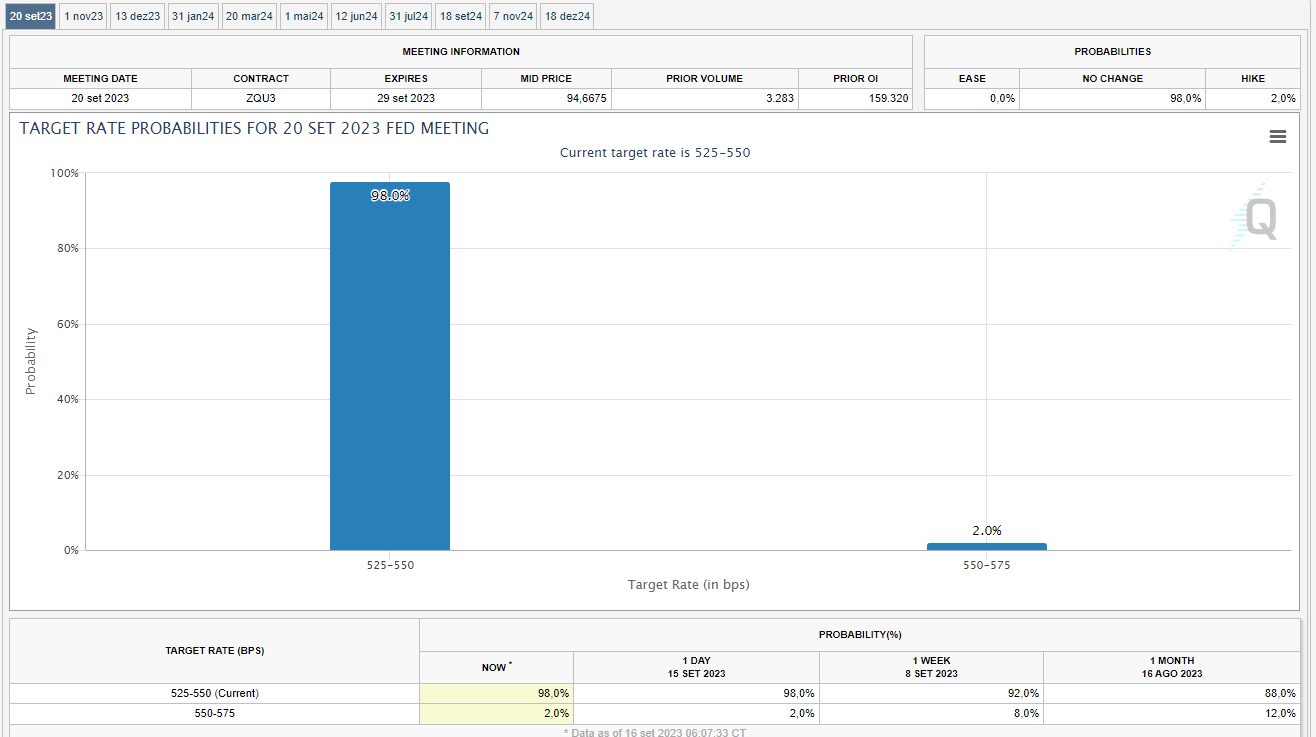

On March 16, 2022, the Federal Reserve (FED) began its schedule of interest rate hikes to curb inflation, raising its rate for the last time by 0.25 percentage points in July 2023. After a pause in June, it maintained a range between 5.25-5.5%, the highest level in 22 years.

The Consumer Price Index (CPI), used as the primary inflation indicator in the United States, regained strength in August, accelerating compared to the previous month. In the release on September 13, the CPI increased by 0.6% on a monthly basis (MoM) and rose by 3.7% on an annual basis (YoY) — in line with market estimates of 0.6% and 3.6%, respectively.

Source: Investing.com - Monthly CPI (MoM)

Oil

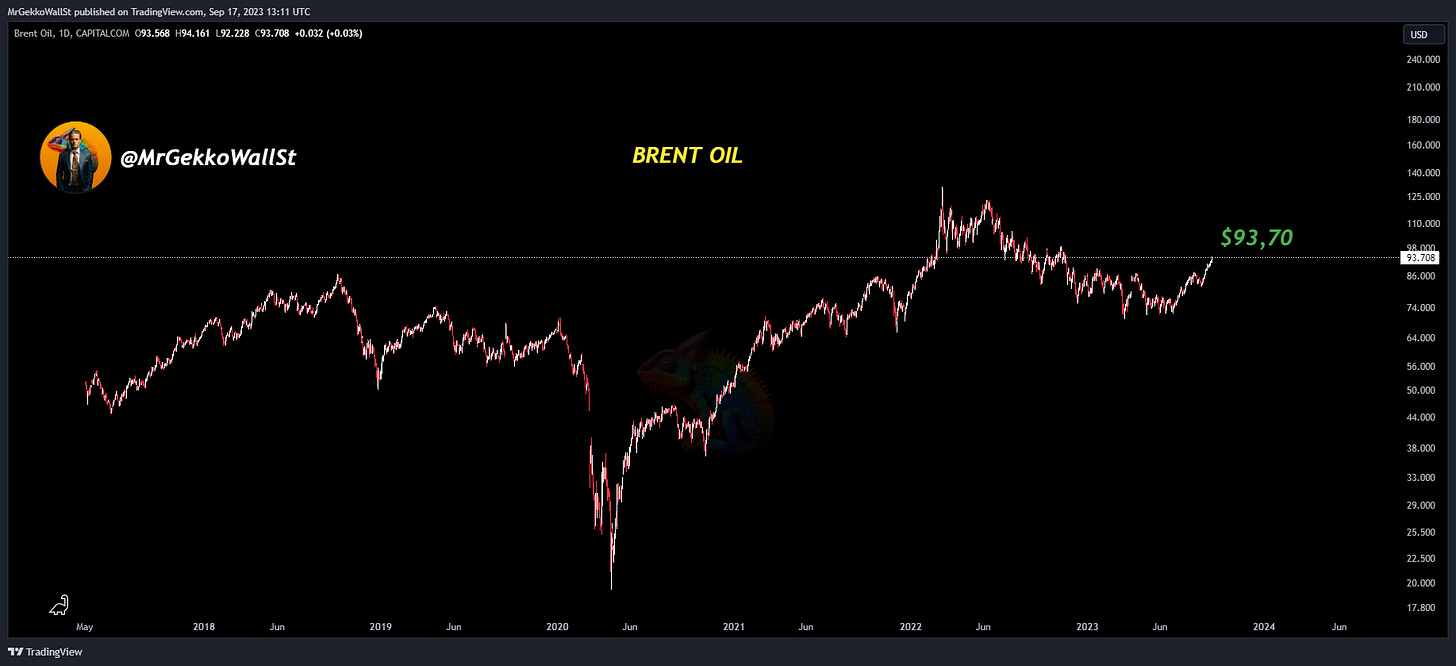

The fluctuation in oil prices is one of the key factors affecting inflation data. On Friday, September 15th, Brent crude oil closed the week at $93.70 per barrel, reaching the highest levels seen in 2023.

Fed Interest Rate

Even with these considered poor data, the market is pricing in a 98% chance of a pause in the Federal Reserve's FEDFUNDS (benchmark interest rates) hike on September 20th.

Source: CME FedWatch - September 16, 2023

Final thoughts:

Tops and bottoms are always marked by extremes. As I briefly illustrated in the introduction, extreme optimism marked the peak of Bitcoin in April 2021. We found the same extreme and opposite sentiment in the $15,000 region after the crash justified by the FTX exchange fraud.

It's essential to understand that the movements of an asset occur through reactionary forces. In a moment like the last few months of 2022, where Bitcoin was already significantly undervalued, the buying demand was able to surpass the selling supply, initiating a trend reversal.

Analyzing rationally, it didn't make sense to sell Bitcoin during this period. The fundamentals of Bitcoin haven't changed, and the asset's development has never been contingent on the FTX case on November 8, 2022. Even though centralized exchanges have become important players in the ecosystem, the fact is that they are not essential and, in reality, go against the fundamental principles of Bitcoin's decentralization.

Those who were able to set aside fear bought Bitcoin cheaply and with reinforced fundamentals because the failure of FTX further highlighted its necessity.

Therefore, wave I is the result of absorbing a significant capital management inefficiency. The notable features of this wave are the maintenance of an atmosphere of apprehension and disbelief in the trend's continuity. The recent trauma from before still lingers in the emotions of many.

Finally, the market is maintaining some optimism that additional increases in the FEDFUNDS may not be necessary until the last meeting of the year on December 13, 2023. As of now, the probabilities for maintaining a pause until that date are a little over 60%. However, it's necessary to emphasize that the economy is quite dynamic, and new data will be released by then, potentially completely altering the market's interpretation.

Despite the uncertainties, there are good signs that we may be on the verge of starting a new phase in this market, and I confess I am eager to share everything with you. If you enjoyed my first edition, you can't imagine what I'm preparing for the next one.

Don't forget to subscribe to follow me on this journey.

Thank you!

Relevant News

Macro Economy:

Cryptocurrencies:

FTX obtains judicial approval to liquidate $3.4 billion in crypto assets.

Coinbase confirms CEO Brian Armstrong: Coinbase will integrate the Lightning Network.

Two more top executives depart from Binance.US amidst SEC actions and layoffs.

Polygon releases proposals for the 2.0 upgrade and new POL token.

Optimism-powered BNB Smart Chain, opBNB, goes live on the mainnet.

Telegram integrates the TON cryptocurrency wallet, and the token price rises by 7%.

Disclaimer: This is a newsletter, and I want to emphasize that I do not provide financial buying or selling recommendations, and I do not promise quick wealth. You should conduct your own analysis and decision-making. I believe that knowledge is the key to the financial market, and I am committed to sharing insights that can assist you on this journey. If you're not already following this newsletter, please consider subscribing. Every week, I share my analyses, experiences, and also the most relevant news of the week. Let's delve into the fundamentals, charts, and obtain the most valuable insights from the financial market!