The deadline for the decision on Bitcoin ETFs is approaching

On October 17th, there will be an SEC mention, and the macroeconomic outlook appears favorable.

Welcome to MrGekkoWallSt's virtual office!

This is issue number 05 of my newsletter! Here, I organize and share my insights on the market, technical analysis, education, experiences, reflections, and the most relevant news of the period.

Looking back...

If you missed edition 04, I presented a chart containing the monthly gains and losses history of Bitcoin since 2013.

Historically, it has been observed that October tends to be one of the best months in the asset's performance. To extract more information about this, visit my previous post by clicking here.

I've noticed that some people are either eager or skeptical about this, probably because Bitcoin rose more than 5% in the first two days of the month, revisiting the $28,000 mark and then correcting again.

What many don't pay attention to is that most of the historical gains in October are concentrated in the last 2/3 of the month.I believe this phenomenon is explained by the immediate nature of human behavior.

Contrarian intuition is the strongest and driving force in the market, so it's healthy when expectations are dissipated first, efficiently capturing the liquidity of the impatient.

Another thing that happens quite often is the hindsight bias combined with the devaluation of simple information. In other words, if we have an excellent October closing, people will look back and claim it was obvious, mentally punishing themselves for staying out.

Obviously, there are no guarantees that things will happen this way; I'm just sharing what I've observed during my experiences.

In this week's analysis, I will address:

Bitcoin ETFs are becoming increasingly likely.

EUR/USD is trading at a critical support.

Gold may be indicating something very important.

Bitcoin ETFs

In August, Michael Novogratz, CEO of Galaxy Digital, during a company earnings conference call, said: "I don't think it's a consensus that we'll probably have a tradable ETF by early December. I don't think people understand how important this is. Invesco has been our partner in this, we want to win, but so does Cathie Wood, as well as BlackRock, Fidelity, and others. There are seven or eight incredible competitors, and I think we'll launch the same bet."

Novogratz's Galaxy Digital is one of the many contenders for a spot Bitcoin ETF, to which they applied again in June, in partnership with the $1.5 trillion asset manager Invesco - the fourth-largest ETF issuer in the United States.

Of course, Novogratz has once again engaged in a major speculation, as this topic has been discussed quite intensively since 2018. However, it's undeniable that some actions and rumors have gained more credibility in recent months.

Institutions are lining up for BTC/ETH spot ETFs. Over 9 major players have requested Bitcoin spot ETFs, including Blackrock, Ark, Wisdom Tree, Fidelity, Franklin Templeton, Valkyrie, and Bitwise, to name a few.

October 17, 2023, will be the second deadline for an SEC mention regarding the applications from VanEck, Wisdomtree, and Fidelity.

What to Keep an Eye On?

The lack of regulatory clarity is one of the aspects that deter many key players from the cryptocurrency market. Therefore, the approval of a Bitcoin ETF will be a significant step toward overcoming this barrier.

The year 2024 is approaching, and there will be a presidential election in the United States, along with the Bitcoin halving.

An election year can be quite volatile. The market recognizes that during election periods, the incumbent president aims for re-election, making it a year more prone to fiscal irresponsibilities to achieve this goal.

Based on this, the market may be pricing in interest rate cuts over this period. Keep in mind that the market seeks to discount the future.

Other stimuli such as debt repurchases may occur. China and other countries are no longer buying American debt securities, and it's becoming increasingly challenging for banks that are in deficit. Due to the dynamics of the current financial system:

As interest rates rise, long-term bonds held by banks that the Federal Reserve "forced" them to buy in the past to finance the growing and unsustainable U.S. debt end up losing value.

This forces the banks to sell to cover the guarantees with their creditors/customers, further contributing to the devaluation of the bonds, and a domino effect occurs.

The situation accelerates when withdrawals begin, exposing banks that are insolvent or close to it, forcing them to liquidate securities or declare bankruptcy.

The market responds with significant systemic drops, and the global collapse follows, requiring immediate intervention from the Fed with stimuli once again (buying back debt, printing 'Brrrrr,' etc.) to prevent it from reaching this point and to keep the financial system afloat, which resembles more of a 'Weekend at Bernie's' scenario:

Watch the movie: https://www.gekkowallstreet.com/2023/10/weekend-at-bernies-online-download.html

If the first ETF is approved, the others will probably also be for legal reasons.

There is evidence that the halving no longer has the impact on the price of Bitcoin it once did, but its psychological effect is still quite strong.

The combination of all these events could bring more publicity to the market and strongly affect the supply and demand relationship, in other words, the price.

Other observations

EUR/USD

Currently, the EUR/USD parity is trading at a very important support level.

In this chart, an appreciation means that the dollar is getting weaker relative to the euro.

If this crucial support is lost, the trend would be for the euro to become stronger than the dollar.

The ideal scenario for increased liquidity in risk markets is for the support to hold, as today, dollar appreciation would mean global risk protection.

Therefore, it's important to analyze this parity to understand the movements of the Dollar Index (DXY) and its potential implications for equities.

GOLD

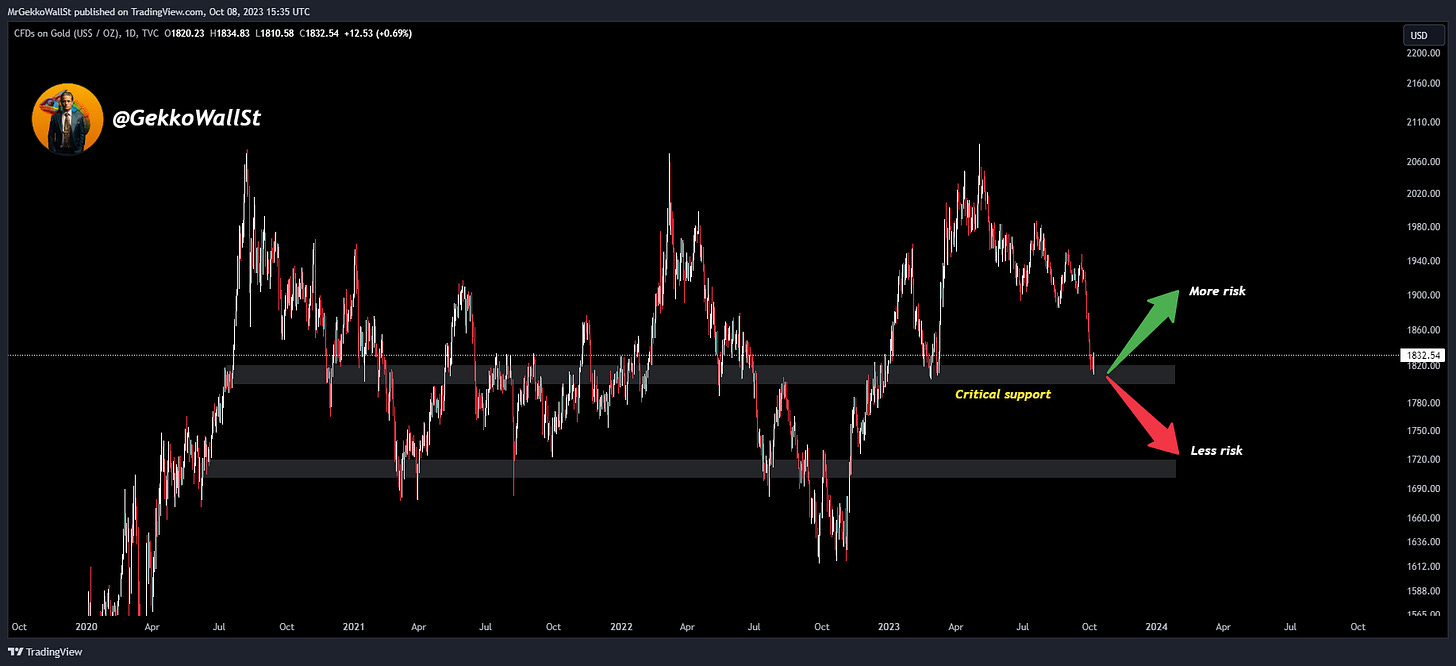

Gold has been on a downtrend since May 2023. Currently, it's also trading at a significant support level.

As a store of value, an increase in the value of gold can indicate that the environment is becoming riskier.

In theory, holding the support or breaking it can signify an intensifying risk appetite.

Gold can also serve as a crucial liquidity indicator for the markets.

Final Thoughts:

The market's decision-making turning points are becoming more pronounced. October is still in its early stages and could mark the resurgence of the Bitcoin journey.

The end of the year promises to be exciting, and 2024 is approaching with high expectations. Keep following my newsletter to receive the best insights and stay updated.

Relevant News:

Macroeconomy:

US Supreme Court rebuffs lawyers punished after 'woeful' suit backing Trump

The Pentagon warns Congress it is running low on money to replace weapons sent to Ukraine

Kevin McCarthy removed as House speaker in historic vote: Highlights

Cryptocurrencies:

Lawsuit accuses Binance and CEO of unfairly triggering collapse of competitor FTX

Bitcoin Reserve on Central Crypto Exchanges Hits 5-Year Low!

Friend.tech SIM-swap scourge continues as scammer nets $385K in Ether

Solana's TVL Surges to Highest Level Since the Start of 2023

Judge rejects SEC’s motion to file an appeal against Ripple ruling

Tokenized U.S. Treasuries Arrive on Coinbase’s Base with Backed’s RWA Token Issuance

THORSwap Pauses Platform After Series of FTX Hack-Linked Trades

Disclaimer:

This is a newsletter where I publish my unbiased analyses and considerations that should not be taken as advice or recommendations. I do not provide financial recommendations for buying, selling, or holding assets, and I do not promise quick wealth. You should conduct your own analysis and decision-making. I believe that knowledge is the key to the financial market, and I am committed to sharing insights that can help you see the market from different angles. If you're not already following this newsletter, consider subscribing. Every week, I share my analyses, experiences, and the most relevant news of the week. Let's investigate the fundamentals, charts, and gather the most valuable insights from the financial market!